15+ Pslf calculator

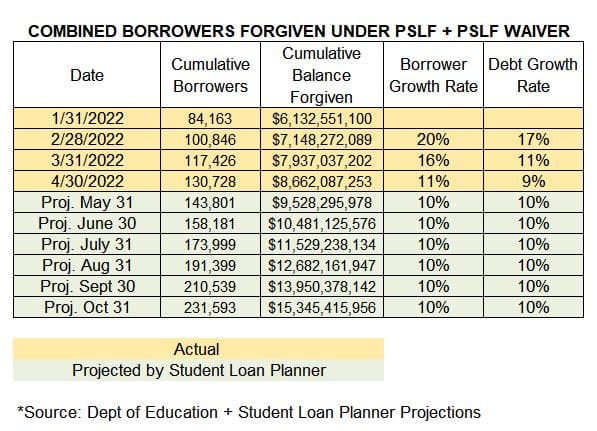

0 15 and 20. June 15 2022PSLF waiver earlier this year.

Public Service Loan Forgiveness Calculator Dollargeek

Clergy and employees of not-for-profit organizations engaged in faith-based work may now qualify for the Public Service Loan Forgiveness PSLF Program.

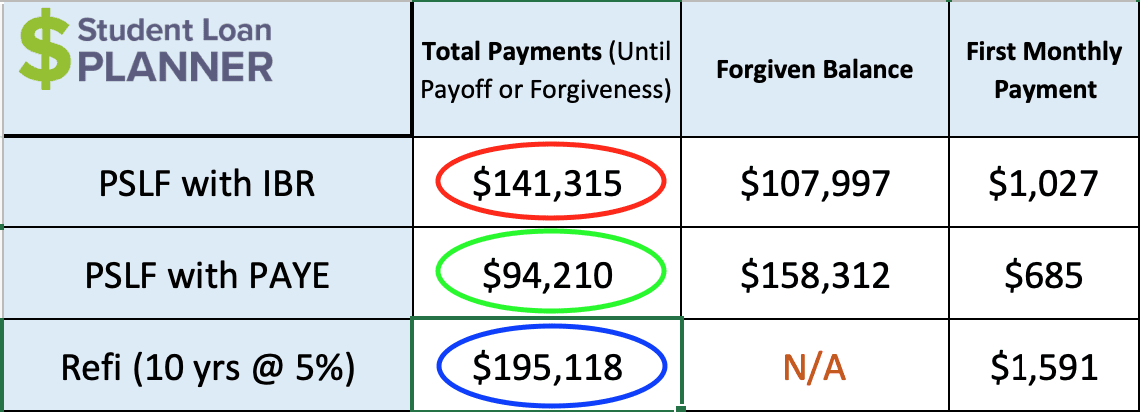

. Financial aid calculator that gives an early estimate of eligibility for federal aid and helps students understand their options for paying for college. Temporary Expanded Public Service Loan Forgiveness TEPSLF allows payments. You can have the balance of your student loan forgiven after 20 or 25 years depending on when you took out your loan if you have a federal loan and youre on an income-based repayment IBR plan.

Use an online student loan refinancing calculator to get a sense of what your new monthly payments. If you are a new borrower on or after July 1 2014 you will have a 20-year repayment period. If you are an older borrower you will have a.

The rate will not increase more than once per month. 15-Year Vs 30-Year Mortgage Calculator Mortgage Refinance Calculator Mortgage APR Calculator Mortgage Payoff Calculator. PSLF So if Bidens.

The maximum rate for your loan is 895 if your loan term is 10 years or less. Courtesy of Nancy Wadsworth After a. Our mission is to empower military veterans and their families through education and tuition assistance program information for college universities.

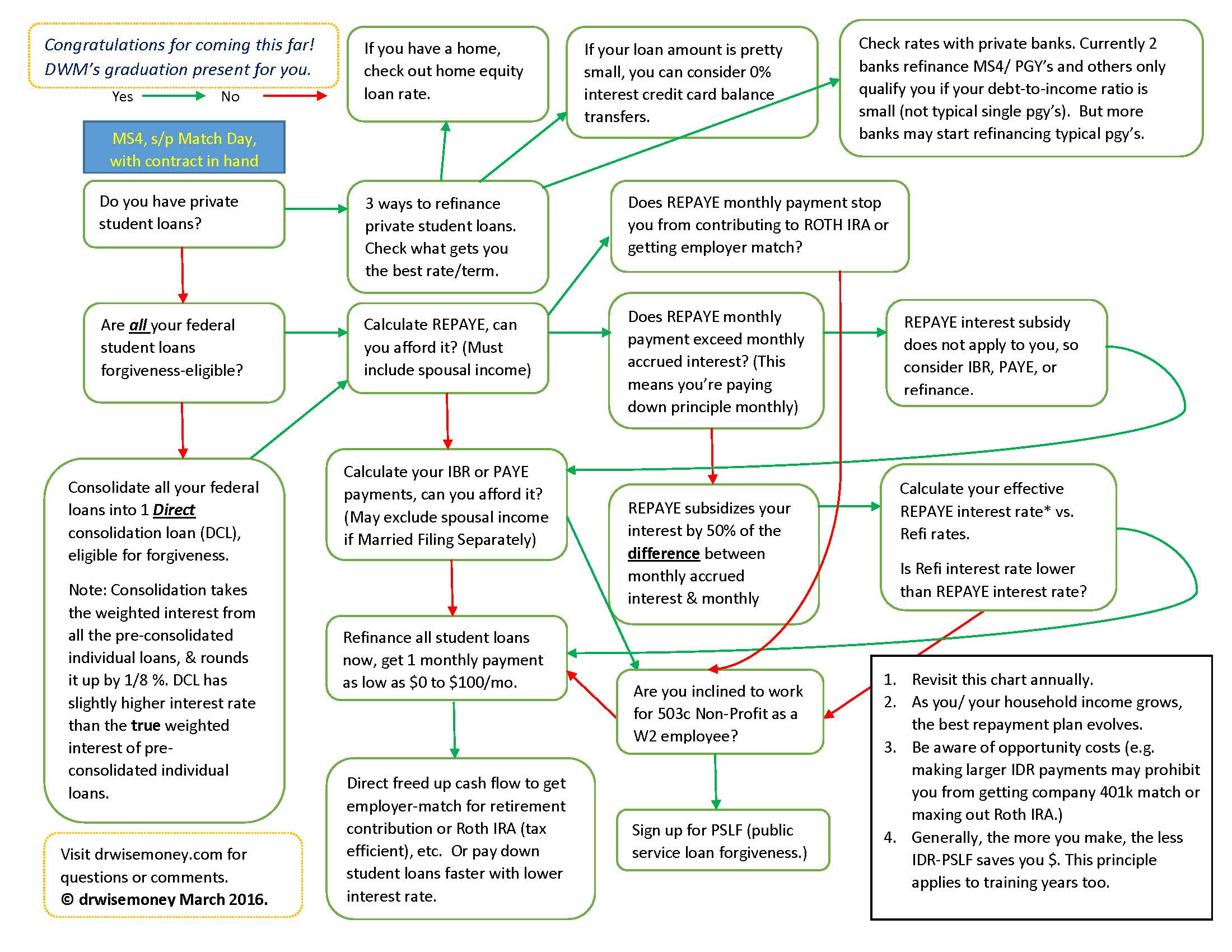

Sep 15 2022 0202pm EDT. Your payments may not qualify for PSLF if you dont enroll in an IDR plan or if you fail to recertify. This calculator determines the monthly payment and estimates the total payments under the income-based repayment plan IBR.

The more favorable temporary rules expire October 31. If you are enrolled in any of the BU Health Plans you are eligible for reimbursement of up to 8 at-home COVID-19 diagnostic tests per month for each enrolled member in the plan as of Saturday January 15 2022. All federal student loans are eligible except those that are in default Parent PLUS loans and Parent PLUS consolidation loans.

PSLF but it is a little complicated. Perkins loans and Federal Family Education Loans FFEL do qualify however subsequent to the DOEs October 2021 changes. Long-term capital gains are taxed at only three rates.

Address Texas Tech University 2518 15th Street Lubbock TX 79409. 15 Myths Were Busting About the FAFSA. Have or get Direct Loans by consolidating loans made under other loan programs into a Direct Consolidation Loan.

Wait 20 or 25 Years or Maybe Only 10. Quotes displayed in real-time or delayed by at least 15 minutes. If you do not have a partial financial hardship your monthly payment will be 15 of your discretionary income.

Private student loans dont qualify. PSLF Form August 2022 Result Type. The deadline to apply for this consolidation is October 31 2022.

Discretionary income is what you have left after. Tuition waivers sometimes referred to as nonresident tuition exemptions allow out-of-state students to pay tuition at in-state ratesThese waivers can help reduce costs since out-of-state. The actual rates didnt change for 2020 but the income brackets did adjust slightly.

Check out this article for what PSLF is and whether you qualify. For loan terms of more than 10 years to 15 years the interest rate will never exceed 995. To opt into the limited PSLF waiver you must do two things.

Teacher Loan Forgiveness. The repayment period for I BR is 20 or 25 years depending on when you took out your loans. In addition several of the PSLF Programs normal eligibility requirements have been temporarily suspended.

The Public Service Loan Forgiveness Program is a federal program that forgives federal student loans for borrowers who are employed full-time more than 30 hours per week in an eligible federal state or local public service job or 501c3 non. For loan terms over 15 years the interest rate will never exceed 1195. Web Resource or Tool.

The PSLF program provides relief to federal direct student loan borrowers who work for government nonprofit organizations and in public service careers that benefit society but often pay modest. At-Home COVID-19 Test Kits Covered. Payments must be made while enrolled in an IDR plan.

Remember this isnt for the tax return you file in 2022 but rather any gains you incur from January 1 2022 to December 31 2022. 15 2022 Photo by Adobe Stock Illustration by Bankrate Advertiser Disclosure. The College Discovery Platform Built Exclusively for the Military Uncover College Education Benefits for Military Service Members Veterans.

Republicans propose bill to eliminate student loan cancellation and other current student loan news for the week of Aug. However time is of the essence. 10 15 or 20 depending on the specific income-driven repayment plan you choose.

Attendings Can You Share How You Paid Off Are Paying Your Debt Student Doctor Network

Public Service Loan Forgiveness Calculator Dollargeek

Public Service Loan Forgiveness Calculator Dollargeek

Stressed About Debt Student Doctor Network

Public Service Loan Forgiveness Calculator Dollargeek

Pslf Waiver How To Qualify Latest Updates Student Loan Planner

How Much Should I Have Saved In My 401k By Age

Is Becoming A Nurse Practitioner Worth It Student Loan Planner

Public Service Loan Forgiveness Calculator Dollargeek

Pslf Waiver How To Qualify Latest Updates Student Loan Planner

Tepig 100 Iv Chart By Level R Thesilphroad

Pslf Waiver How To Qualify Latest Updates Student Loan Planner

Pslf Waiver How To Qualify Latest Updates Student Loan Planner

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Public Service Loan Forgiveness Calculator Dollargeek

Attendings Can You Share How You Paid Off Are Paying Your Debt Student Doctor Network

Public Service Loan Forgiveness Calculator Dollargeek